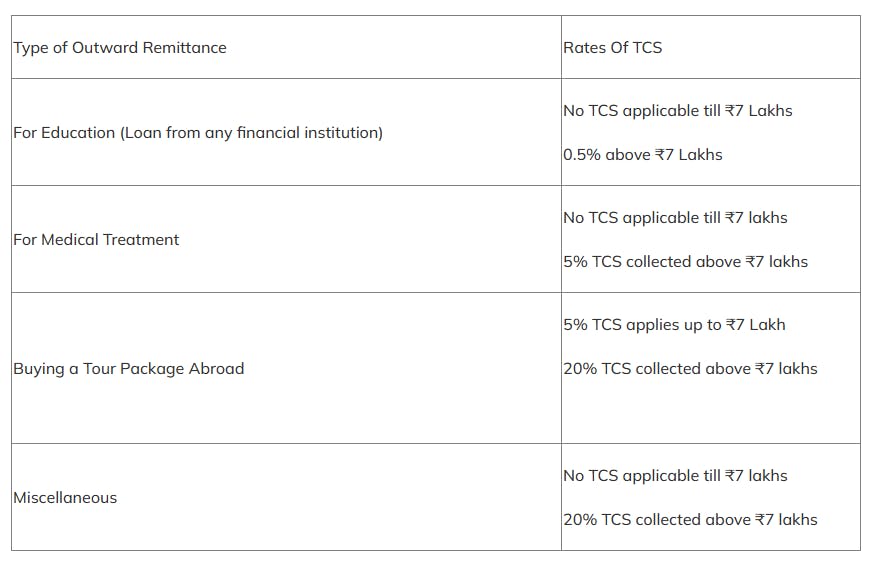

TCS On Foreign Remittance For Payments & Sending Money Abroad From India

Are you struggling to understand advanced tax systems such as TCS? Taxes in India can get complex, especially if it is related to foreign investments or foreign travel. As the top GST consultant in Gurgaon, we are here to guide you on tax on foreign remittance in India. Keep reading this blog to learn about TCS for foreign remittance: