APPEAL TO INCOME TAX DEPT. BEFORE CIT(A)

Navigate the appeal process to Income Tax Dept. with precision. Learn key strategies for a successful appeal before CIT(A) for tax-related matters.

Navigate the appeal process to Income Tax Dept. with precision. Learn key strategies for a successful appeal before CIT(A) for tax-related matters.

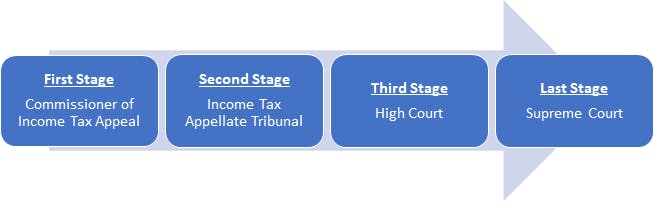

There are various recourse available to assessee to challenge the orders passed by the Assessing Officer at the time of assessment. The Income Tax Law provides recourse in the form of revision or by filing an appeal. The various stages of filing appeal is described below –

This article describes various provisions relating to filing of Income Tax Appeal before CIT(A) in depth. For the sake & convenience of readers, we have prepared the article in the form of Questions and Answers.

Appeal can be filed before Commissioner (Appeals), when a tax payer is adversely affected by Orders as under passed by various Income tax authorities, a list of such few orders are as under –

Every appeal to the Commissioner (Appeals) is to be filed in Form No. 35 online. Form 35 contains basic information like name and address of taxpayer, Permanent Account Number (PAN), assessment year, details of the order against which appeal is filed etc.

Along with that, Grounds of Appeal & Statements of Facts have to be furnished covering brief facts and ground of appeal of the case.

Fees to be paid before filing appeal to the Commissioner (Appeals) depends upon total income determined by the Assessing Officer. Fees as under are to be paid and proof of payment of fee is to be attached with Form No. 35

S.No.Total Income determined by the Assessing OfficerAppeal Fee1Less than Rs. 1,00,000/-Rs 250/-2More than Rs.1,00,000/- but less than Rs.2,00,000/-Rs 500/-3More than Rs. 2,00,000/-Rs 1000/-

Appeal is to be filed within 30 days of the date of service of notice of demand relating to assessment or penalty order or the date of service of order sought to be appealed against, as the case may be. The Commissioner (Appeals) may admit an appeal after the expiration of period of 30 days, if he is satisfied that there was sufficient cause for not presenting the appeal within the period of 30 days. Application for condoning the delay citing out reasons for the delay along with necessary evidences & an affidavit signed by the appellant confirming the condonation should be filed with Form No. 35 at the time of filing of appeal. Commissioner (Appeals) can condone the delay in filing the appeal in genuine cases with a view to dispense substantive justice.

During appeal proceedings, the tax payer is not entitled to produce any evidence, whether oral or documentary other than what was already produced before the Assessing Officer. Commissioner (Appeals) would admit additional evidence filed only in following situations:

The notice of demand clearly specifies the name and jurisdiction of the officer with whom appeal can be filed.

After filing appeal online, it is advisable to submit the following documents offline

CBDT In this regard has issued an office memorandum in July 2017 to allow a pre deposit of 20%(previously 15%) of demand for filing appeal to CIT(A)

However Supreme Court in a case held that, the tax authorities cannot take recourse to the office memorandum issued by CBDT and demand minimum of 20% of the disputed demand for granting all the stay matters. The SC clarified that the Commissioners have wide powers as a quasi-judicial authority to grant stay of demand on payment of stay amount lesser than 20% of the disputed tax demand. The tax authorities have to analyse the merits of each individual case and depending on the facts, can grant stay at a lesser amount.

Section 282 of the Income-tax Act, 1961, lays down the mode of service of notices. According to it, any notice under the Income-tax Act has to be served on the person named therein either by post or as if it were a summons issued by the court under the Code of Civil Procedure, 1908. Order V of rule 19A of the Code of the Civil Procedure, provides for simultaneous service by post in addition to personal service. Under Order V, rule 17 of the Code, the affixation can be done only when the assessee or his agent refuses to sign the acknowledgement or cannot be found. The notice sent by the registered post should be sent along with the acknowledgement due.

So simply speaking, if the assessee has not received the order, government should not have any proof of service of notice. Also now a days, e-assessment is going on, in that case also any assessment served online in efiling potal shall not be deemed to be proper service since it is not in consonance with Section 282.

Assessee in these cases can visit to concerned AO, and on payment of prescribed fees, he can inspect the file and take photocopies of desired documents like assessment order, notice of demand etc and date of service shall be the date on which he inspect the file.

Disclaimer: Anything written in this document is the personal understanding of the author. The author shall not be responsible for any of the decisions made based on the contents of this document.

Facing GST registration rejection? Discover rejection reasons and resolve GST registration issues. Ensure a smooth application process in 2026.

Dispute Resolution Panel (DRP) in Income Tax: Learn about alternative dispute resolution mechanism for income tax disputes and transfer pricing litigation.

Build a strong transfer pricing defense file. Ensure compliance and avoid tax disputes with crucial transfer pricing documentation and audit readiness.